"Corporate Banking Solutions Market Size, Share, and Trends Analysis Report—Industry Overview and Forecast to 2031

The Business Banking Services Market is undergoing significant transformation, driven by technological advancements, shifting consumer preferences, and increasing industry investments. According to top market research companies, the Enterprise Financial Services Sector is witnessing rapid growth as businesses prioritize innovation and efficiency. Companies in the Corporate Financial Solutions Industry are focusing on data-driven strategies, digitalization, and automation to enhance productivity and meet rising demand. The Institutional Banking Systems Market is also seeing strong momentum due to regulatory support and evolving industry standards. Leading players in the Commercial Banking Platforms Market are leveraging advanced analytics and market intelligence to stay ahead of competitors, making the market highly dynamic and competitive.

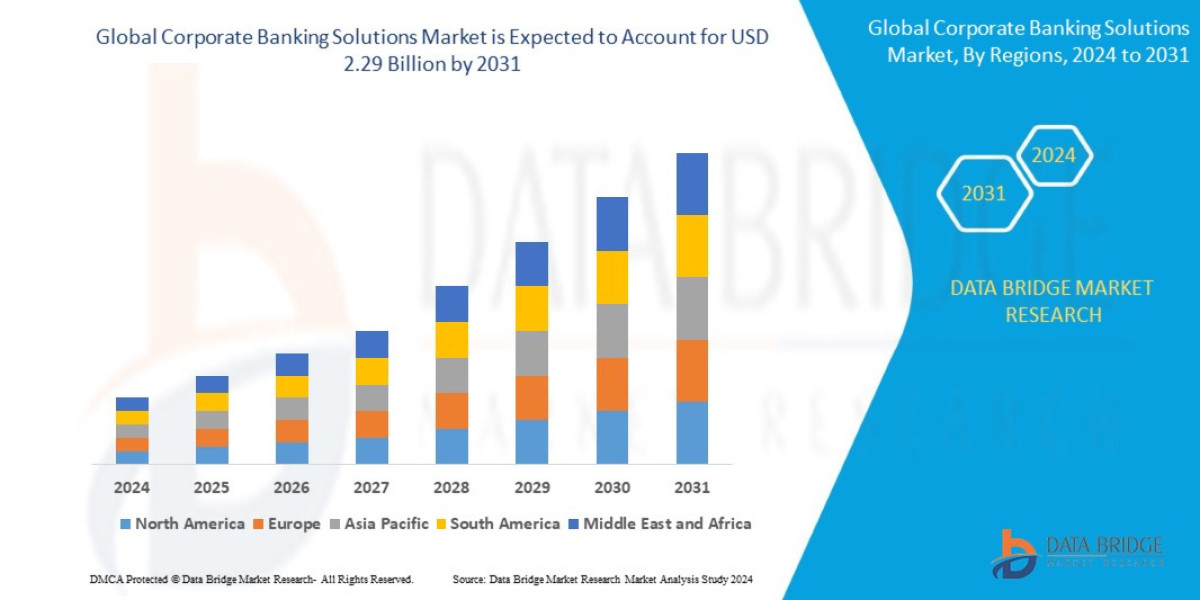

The Corporate Banking Solutions Market is poised for significant growth, with a market outlook highlighting substantial growth potential driven by emerging opportunities in key sectors. This report provides strategic insights, demand dynamics, and revenue projections, offering a comprehensive view of the future landscape, technology disruptions, and adoption trends shaping the industry’s ecosystem evaluation. According to Data Bridge Market Research Global corporate banking solutions market size was valued at USD 1.58 billion in 2023 and is projected to reach USD 2.29 billion by 2031, with a CAGR of 4.80% during the forecast period of 2024 to 2031.

We believe understanding the B2B Banking Technology Market requires more than just numbers; it's about grasping the human element. Our research dives into the motivations and behaviors driving the Corporate Banking Solutions Market, uncovering the stories behind the data. We're observing how diverse factors are influencing the Corporate Lending Services Sector, from regulatory changes to emerging trends. This approach allows us to provide a comprehensive picture of the Corporate Banking Solutions Market, equipping businesses with the knowledge to make strategic decisions. We focus on delivering insights that are relevant and actionable within the current context of the Business Accounts & Treasury Market. The current state of the Corporate Banking Solutions Market shows interesting trends. We want to provide clear information on the Commercial Finance Solutions Market. The dynamic nature of the Corporate Finance Tech Industry is always changing.

Our comprehensive Corporate Banking Solutions Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://www.databridgemarketresearch.com/reports/global-corporate-banking-solutions-market

**Global Corporate Banking Solutions Market Analysis**

The global corporate banking solutions market is experiencing significant growth and transformation driven by technological advancements and evolving customer needs. Corporate banking solutions cater to the specialized financial needs of businesses, providing services such as cash management, trade finance, lending, risk management, and digital banking. The market has witnessed a surge in demand for integrated and efficient banking solutions that streamline operations, enhance security, and improve decision-making processes. As businesses seek to optimize their financial functions and adapt to a digital-first environment, the corporate banking solutions market is poised for continued expansion.

**Segments**

1. **Product Type:**

- Core Banking Solutions

- Multi-Channel Banking Solutions

- Online Banking Solutions

- Mobile Banking Solutions

- Others

2. **Deployment Mode:**

- Cloud-based

- On-premises

3. **Enterprise Size:**

- Large Enterprises

- Small and Medium Enterprises

4. **End-User:**

- Retail

- Healthcare

- Manufacturing

- IT and Telecom

- Others

**Market Players**

- Finastra

- FIS

- Tata Consultancy Services Limited

- Infosys Limited

- Oracle

- Fiserv, Inc.

- Temenos Headquarters SA

- Intellect Design Arena Ltd

- EdgeVerve Systems Limited

- Path Solutions

The global corporate banking solutions market is witnessing several key trends shaping its growth trajectory. One prominent trend is the increasing adoption of cloud-based solutions by banks and financial institutions. Cloud technology offers scalability, cost-efficiency, and flexibility, enabling organizations to deploy banking solutions more rapidly and effectively. Additionally, the rise of digital banking and mobile solutions is driving the demand for user-friendly interfaces, real-time transaction processing, and personalized services.

Furthermore, the market is being driven by the growing emphasis on cybersecurity and data protection in the banking sector. With the rise of cyber threats and regulatory requirements, banks are investing in robust security measures to safeguard customer data and prevent fraudulent activities. This focus on security is influencing the development of advanced authentication methods, encryption techniques, and compliance solutions within corporate banking platforms.

Despite the positive growth prospects, the global corporate banking solutions market faces challenges that could impact its expansion. One such challenge is the complexity of legacy systems and the integration of new technologies. Many banks struggle with legacy infrastructure that hinders agility and innovation, making it difficult to adopt modern banking solutions seamlessly. Overcoming legacy constraints requires substantial investments in system upgrades, data migration, and staff training to ensure a smooth transition to new platforms.

In conclusion, the global corporate banking solutions market is poised for robust growth driven by technological advancements, changing customer expectations, and regulatory dynamics. As banks and financial institutions continue to prioritize digital transformation and customer-centric strategies, the market players mentioned above are well-positioned to capitalize on emerging opportunities and drive innovation within the corporate banking sector.

https://www.databridgemarketresearch.com/reports/global-corporate-banking-solutions-market

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies in Corporate Banking Solutions Market : https://www.databridgemarketresearch.com/reports/global-corporate-banking-solutions-market/companies

Key Questions Answered by the Global Corporate Banking Solutions Market Report:

- How does the market share of leading companies compare in the Corporate Banking Solutions Market?

- What is the scope of applications for LSI technology across various industries?

- How is the demand for LSI products shifting across different regions and sectors?

- What are the primary growth factors driving the expansion of the Corporate Banking Solutions Market?

- What is the market value projection for the Corporate Banking Solutions Market over the next decade?

- What are the emerging opportunities for new entrants in the Corporate Banking Solutions Market?

- What do industry statistics reveal about investment trends in the Corporate Banking Solutions Market?

- What are the latest industry trends influencing the adoption of LSI technology?

- How does the industry share of small vs. large companies compare in the Corporate Banking Solutions Market?

- What are the key revenue drivers impacting the profitability of Corporate Banking Solutions Market companies?

Browse More Reports:

https://www.databridgemarketresearch.com/reports/global-brewers-yeast-market

https://www.databridgemarketresearch.com/reports/global-building-thermal-insulation-materials-market

https://www.databridgemarketresearch.com/reports/north-america-diagnostic-tests-market

https://www.databridgemarketresearch.com/reports/global-monoclonal-antibodies-market

https://www.databridgemarketresearch.com/reports/global-medical-devices-cuffs-market

Data Bridge Market Research:

☎ Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 982

✉ Email: corporatesales@databridgemarketresearch.com

Tag

Corporate Banking Solutions Market Size, Corporate Banking Solutions Market Share, Corporate Banking Solutions Market Trend, Corporate Banking Solutions Market Analysis, Corporate Banking Solutions Market Report, Corporate Banking Solutions Market Growth, Latest Developments in Corporate Banking Solutions Market, Corporate Banking Solutions Market Industry Analysis, Corporate Banking Solutions Market Key Players, Corporate Banking Solutions Market Demand Analysis"